Wait! Don’t go!

You’re in!

Your request has been submitted. Keep an eye on your inbox; EDC’s trade intelligence is coming your way.

Are you missing out?

You’re in!

Your request has been submitted. Keep an eye on your inbox; EDC’s trade intelligence is coming your way.

The economic outlook across North America is gloomy, as decades of economic co-operation are fractured by trade friction. Trade tensions among members of the Canada-United States-Mexico Agreement (CUSMA) have wiped out trillions of dollars off equity markets and disrupted investments and supply chains.

After enduring months of skyrocketing prices and heavy borrowing costs, North Americans were beginning to feel relief as inflation slowed and central banks cut interest rates. But this hope is now in jeopardy as the U.S. imposes stiff tariffs on Mexico and Canada. In response, Canada has implemented retaliatory tariffs on certain U.S. imports. These tit-for-tat measures could spiral out of control, causing wider and deeper damage.

The economic uncertainties created by the trade war come against a backdrop of high indebtedness among North American households with limited savings. This makes them vulnerable to economic shocks. Additionally, housing prices are sky-high, putting homeownership out of reach for many. High mortgage rates have suppressed new home construction and increased immigration has put upward pressure on rental prices. Until the supply gap is addressed, housing will continue to strain household budgets and limit discretionary spending across the continent.

Given these vulnerabilities, the trade war has increased the likelihood of a recession in Canada and Mexico, while the U.S. economy is losing momentum. Central banks across the continent are likely to ease monetary policies to help support their domestic economies.

You should also check out

With growing risks, Canadian companies face new challenges. EDC’s Global Economic Outlook offers insights to help you make better business decisions.

United States: Economic pressures mounting

U.S. President Donald Trump’s tariffs are adding pressure on the economy:

- Consumption: Declined as households paused debt-fuelled spending.

- Hiring: Slowed, with job cuts on the rise.

- Consumer confidence: On a downward spiral.

These indicators suggest lower consumer spending in the coming months. Businesses need clarity to plan investments and operations, but the uncertainty caused by the tariff war will dampen business activities and hiring. Retaliatory tariffs will weaken demand for U.S. exports and stiff tariffs on imports will lead to sticker price shocks for consumers.

Rising inflation and a weakening economy present a difficult policy choice for the Federal Reserve (Fed). It’s likely the Fed may cut the policy rate as insurance against labour market malaise.

U.S. housing market: Another pain point

Mortgage rates: Unlikely to return to pre-pandemic, sub-4% rates, limiting supply on the resale market and keeping prices high.

Immigration crackdown: Depriving the construction industry of skilled workers and raising wage costs.

Lumber prices: Rising due to tariffs against Canadian supply, limiting new home construction. Countervailing and antidumping duties on Canadian lumber to the United States have been raised to 34%, adding around US$9,000 to average U.S. home prices.

While the tariff war is likely to slow progress of the U.S. economy, a recession is unlikely. Real gross domestic product (GDP) is forecast to slow to 1.7% this year from 2.8% last year, before advancing to 1.9% in 2026, as the initial shock and confusion around the tariffs subside.

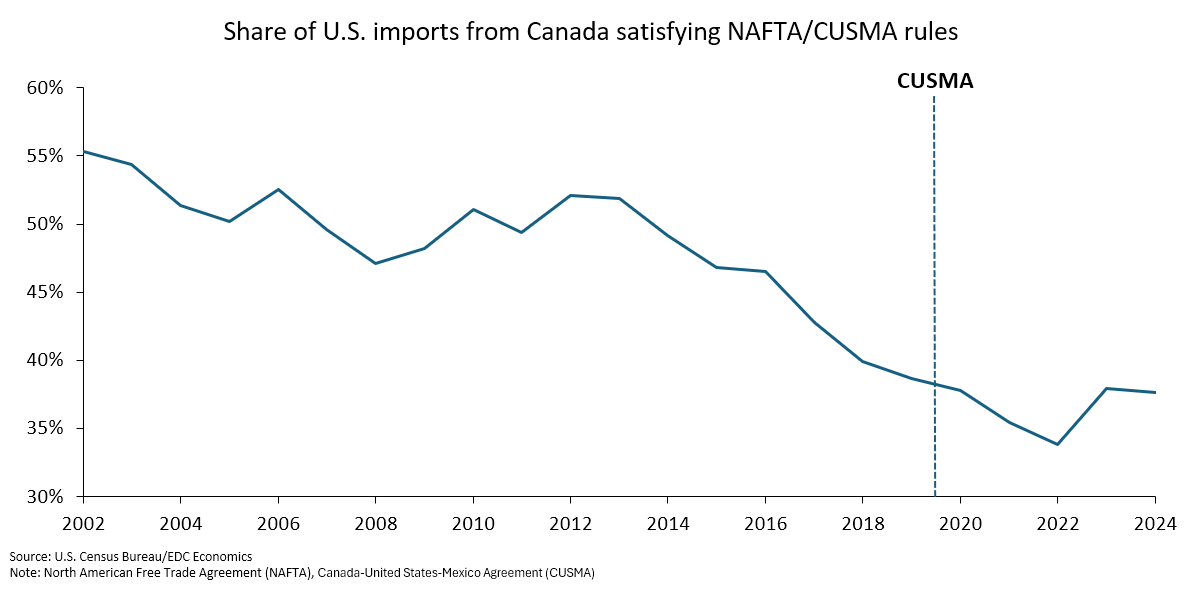

After overcoming high inflation and borrowing costs, Canada’s economy was bracing for growth, but that isn’t likely to happen this year. An unprovoked tariff war is threatening to send the Canadian economy into a recession. President Trump has imposed 25% tariffs on Canadian products that don’t comply with the CUSMA requirements. Only 38% of Canadian exports to the United States complied with the free trade agreement (FTA) last year. With a large portion of our products currently not compliant with CUSMA, tariffs will hurt the Canadian economy. Canadian exporters are now filing paperwork to be CUSMA-compliant, while a new federal government after the April 28 election is expected to usher in bold policies to help guide the Canadian economy through the tariff storms.

Even before the tariffs came into force, the flip-flop announcements caused uncertainty among businesses and led to a decline in business and consumer confidence. This uncertainty has led to investment hesitation and job layoffs, putting the livelihood of Canadian households in jeopardy.

The good news is that given the breadth of Canadian retaliatory measures, inflation isn’t likely to spiral out of control. This will allow the Bank of Canada to focus on minimizing the tariff impact on the labour market. On March 12, it dropped its policy rate by 25 basis points to 2.75% and additional reductions are anticipated. These cuts will help reduce borrowing costs and stimulate domestic demand.

The U.S. tariff threats have forced the Canadian dollar to drop below US$0.70, which will worsen with additional interest rate reductions by the Bank of Canada. The loonie will likely average US$0.66 this year, continuing the downward trend of the last three years.

You should also check out

Expert guidance on how to manage trade regulations, customs requirements and international contracts.

Economic outlook for Mexico: Policy missteps handicap economy

Mexico is dealing with two significant losses due to policy changes:

1. A constitutional reform that weakened institutional quality came into force last September, degrading governance and rule of law—key to attracting foreign direct investments (FDIs). Some previously announced FDIs have been cancelled or put on hold.

2. President Trump’s tariffs are chilling businesses looking to set up operations in Mexico. Notably, Honda is moving its planned Civic Hybrid production from Mexico to Indiana due to the 25% tariff on autos and parts entering the United States. The U.S. accounts for more than 80% of Mexico’s exports, and about half are CUSMA compliant. This means half of Mexican exports are now subject to a 10% baseline tariff, while auto exports face 25% tariffs. These tariffs will likely tilt the Mexican economy into recession this year, with real GDP forecast to slow to 0.3% this year and advance by 0.9% in 2026.

The Mexican economy was already facing high underemployment, particularly among self-employed individuals. These policy changes will worsen the economic situation for Mexicans.

While job prospects at home are slim, Americans are facing a far more consequential deportation situation. To avoid been caught, some undocumented immigrants in the U.S. are sheltering in place, drying up a key source of income for Mexicans who rely on remittances for daily support.

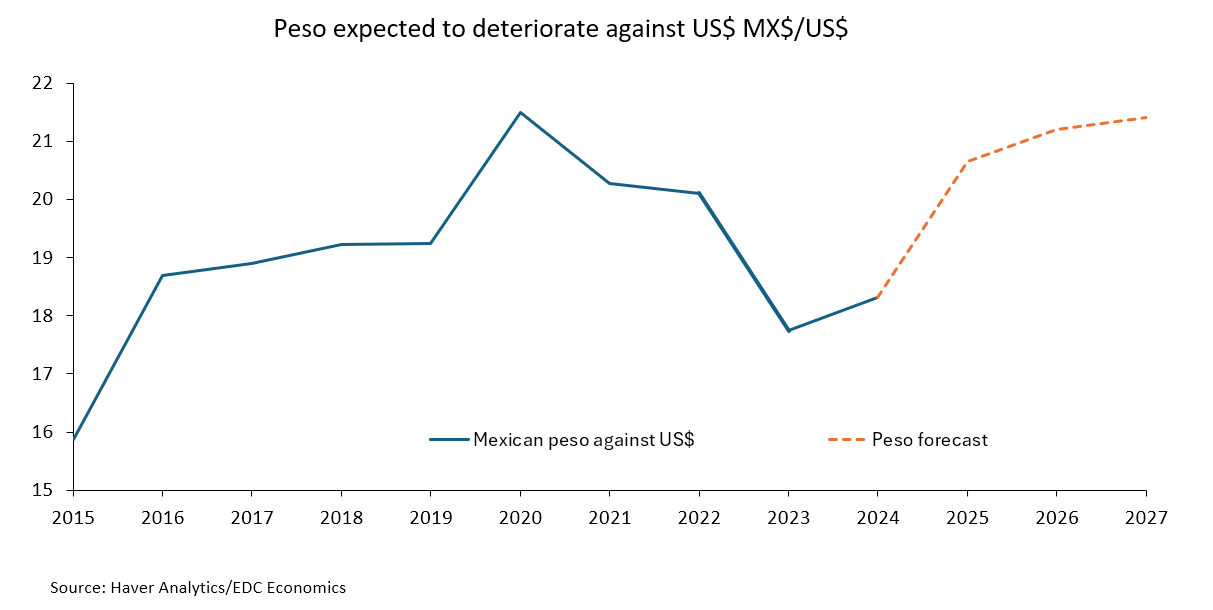

The Mexican government has been careful about imposing tariffs on U.S. goods due to the impact on inflation and domestic production. Given flagging domestic demand, the Central Bank of Mexico is likely to reduce its policy rates. Interest rate cuts will further reduce the peso, with the exchange rate against the U.S. dollar likely to average around MX$20.70 this year and MX$21.20 next year.

How EDC can help

Export Development Canada (EDC) offers several solutions, including market intelligence and business connections, to support Canadian companies in their global expansion. Our sector-focused teams have a range of knowledge and expertise.

On March 7, the Government of Canada announced $6.5 billion in support of businesses impacted by the current trade uncertainty, including the launch of EDC’s Trade Impact Program (TIP). With this newly launched program, EDC is prepared to facilitate an additional $5 billion over two years in support to eligible companies across a range of products to help them navigate economic challenges.

“We have local knowledge of how to do business in different markets, but we also have the right people who have the connections, and we can leverage that benefit to Canadian exporters,” says Jorge Rave, EDC’s regional vice-president for Latin America and the Caribbean.

“We have a significant and strong Team Canada, including the Trade Commissioner Service, as well as our guides on local culture and doing business as a Canadian exporter.”

- To learn more, check out our U.S. market intelligence page for insights on how to navigate that country.

- EDC’s Export Help Hub covers the globe and can connect you with EDC trade advisors who can answer your questions, help you understand your challenges and help you find solutions for them. They specialize in markets and strategies and customs and regulation requirements.

- EDC offers the Business Connections program, which promotes Canadian export capabilities to international buyers.

New to EDC? Take a quick assessment to see how we can support your business.

Already an EDC customer and need to stay informed on the current U.S. business environment and issues related to Canada-U.S. trade? Contact your EDC relationship manager or call us at 1-800-229-0575.

For Canadian exporters who need to mitigate risk, EDC offers financial and risk management solutions and tools, including the Country Risk Quarterly.